Our Story

Credit unions in the Carolinas were born of unique versions of a similar story. Discover the rich history of how the League and Carolinas' credit unions were born.

History of Credit Unions

For more than 100 years, credit unions have provided financial services to their members in the United States. Learn how credit unions came to be.

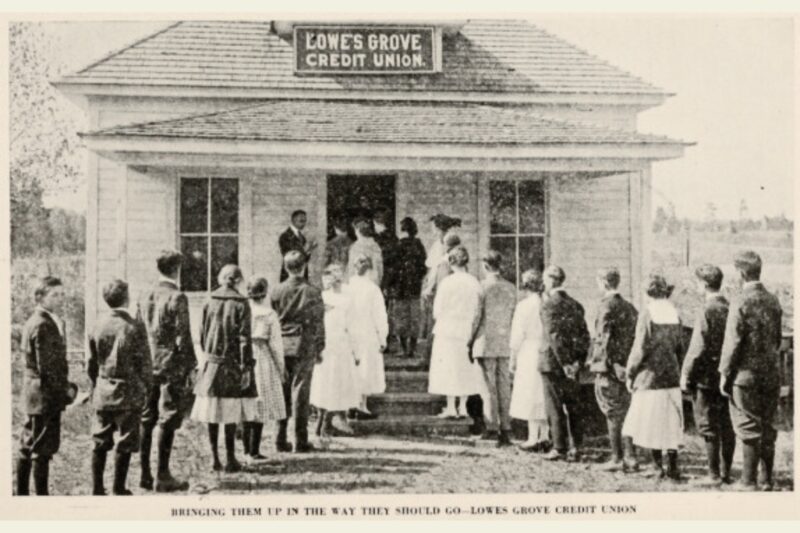

History of Carolinas' Credit Unions

Credit unions in the Carolinas each saw cause for applying cooperative principles in extending credit among those hard pressed to find it through traditional means. Thus, starting a movement that would blossom into the credit unions and unified league we have today.

Credit Union FAQs

A credit union is a community-based, member-owned financial institution. Credit unions do not exist to make a profit, but rather to serve their member-owners. Any earnings the credit union makes are returned to the membership in the form of lower loan rates, higher deposit rates, and much lower fees.

Credit unions are funded by their members, who place their money in checking, savings, money market and other deposit accounts. There are no outside investors or shareholders. The funds loaned by credit unions to members are literally the money of other members.

The operating foundation of credit unions and other cooperatives throughout the world are guided by a list of essential cooperative principles. The origins of which were first envisioned in 1844 by a group of weavers in Rochdale, England, and continue to grow and evolve to meet the movement, its members and communities of today.

From very modest means and difficult circumstances, the 28 founders of the Rochdale Society of Equitable Pioneers came together to solve a pressing community need – access to affordable, healthy food. Their efforts not only helped the Pioneers feed their families, but forged seven operating principles that were formally adopted in 1937 by the International Co-operative Alliance and used as a blueprint worldwide among cooperatives.

Today, an exciting conversation is taking place around an Eighth Cooperative Principle for Credit Unions. Envisioned by Local Government FCU and Civic FCU CEO Maurice Smith in 2019, the Eighth Cooperative Principle commits credit unions to an unambiguous focus on Diversity, Equity and Inclusion (DEI). The principle was formally adopted by the US credit union movement in 2019. The Carolinas Credit Union League and Foundation proudly endorse the Eighth Cooperative Principle and supports its inclusion in both the business practices of credit unions as well as educating employees, directors, members and others about its importance to the future of the movement.

The Eight Cooperative Principles

Principle One:

Voluntary and open membership. Credit unions are voluntary, not-for profit financial cooperatives, offering affordable financial solutions to those eligible and willing to accept the responsibilities and benefits of membership, without discrimination

Principle Two:

Democratic member control. Credit unions are democratic organizations owned and controlled by their members, with equal opportunity for participation in setting policies and making decisions. Therefore, each member has one vote.

Principle Three:

Member economic participation. Members are the owners of credit unions. As such, they contribute to the capital of their credit union and directly impact its financial success. Members realize benefits in proportion to their relationship with their credit union and use of its products and services.

Principle Four:

Autonomy and independence. Credit unions are independent, self-reliant organizations controlled by their member-owners, not outside stockholders. Credit unions entering into agreements with other organizations must ensure continued democratic control by the members

Principle Five:

Education, training, and information. Credit unions educate and train members, employees and volunteers so they can contribute effectively to the development of the credit union. In addition, credit unions provide financial education for their members and the public.

Principle Six:

Cooperation among cooperatives. Credit unions serve their members most effectively and strengthen the cooperative principles by working with other cooperatives through local, state, regional, national, and international structures.

Principle Seven:

Concern for community. Credit unions work for the sustainable development of communities through policies developed and accepted by the members. Credit unions seek to achieve a greater good through responsible corporate citizenship.

Principle Eight:

Diversity, Equity and Inclusion. Cooperatives believe we are stronger when a proactive effort is put forth to engage everyone in governance, management and representation.

Want to Learn More? The League in partnership with the Carolinas Foundation offers several training opportunities, including the Principles and Philosophy Conference, a two-day “deep dive” into the history and principles of credit unions and co-ops. The Foundation also provides customized principles training events to your credit union upon request. These events are appropriate for all levels of credit union staff and may be from one hour to one day in length. For more information, please contact Carolinas Foundation Director of Collaborative Programs Jeff Hardin at jhardin@carolinasfoundation.org or 336-601-1764.

Credit unions are the best choice for consumers in the marketplace! They are managed by their members, operated for the benefit of their members, do not have outside shareholders, and their board of directors are not paid. As a result, credit unions offer the best value.

According to America’s Credit Unions’ most recent U.S. CU Profile review, there are approximately 4,953 credit unions in the US as of June 2022, including a total of 113 in North Carolina and South Carolina.

Most people are eligible for membership in a credit union through their employer, academic institution, church, or community of residence. For more on what credit unions offer, visit Your Money Further, and look for credit unions near you via the locator at https://yourmoneyfurther.com/cu-finder.

Yes! Though typically small local or regional organizations, credit unions work together nationwide to provide mainstream financial services. For example, many credit unions have relationships with ATM networks to provide members free, nationwide access to their funds.

Some credit unions also participate in shared branching, through which members can transact business at more than 5,300 locations across the country.