Credit Unions: A Legacy of Service

For over 100 years, credit unions have provided financial services to Americans. These unique depository institutions operate not for profit, but to serve their members as credit cooperatives.

According to the NCUA, the earliest financial cooperatives date back to the early 19th century in England. A few decades later, credit unions began to take root in Germany, where pioneers Hermann Schulze-Delitzsch and Friedrich Raiffeisen laid the foundations for the credit unions we know today, with key characteristics including:

- Democratic governance

- One vote per member, regardless of deposit size

- Member-elected boards of directors

- Volunteer-led leadership

In 1846, a crop failure and famine led Schulze-Delitzsch to establish a cooperatively owned mill and bakery, offering bread to members at significant savings. In 1850, he extended this cooperative idea to address the need for credit by organizing the first cooperative credit society, known as the people’s bank.

Meanwhile, Raiffeisen sought to provide credit to German farmers. In 1864, he formed the Heddesdorf Credit Union to help them purchase livestock, equipment, seeds, and other essentials.

Crossing the Atlantic

By 1900, the credit union concept crossed the Atlantic to Levis, Quebec. Alphonse Desjardins, a court reporter, was moved by the high interest rates charged by loan sharks. In response, he organized La Caisse Populaire de Levis, the first credit union in North America, to provide affordable credit to working-class families.

Almost a decade later, Desjardins helped a group of Franco-American Catholics in Manchester, New Hampshire, form St. Mary’s Cooperative Credit Association, which became the first credit union in the United States when it opened its doors in 1908.

Laying the Foundation in the U.S.

The efforts of merchant and philanthropist Edward Filene and Massachusetts Banking Commissioner Pierre Jay led to the passage of the Massachusetts Credit Union Act on April 15, 1909. This legislation laid the groundwork for subsequent state credit union laws and the Federal Credit Union Act, which would be passed 25 years later.

During the 1920s, the U.S. credit union movement gained popularity. With families having more money to save and the ability to afford products like automobiles and washing machines, they still faced limited access to inexpensive credit. Commercial banks and savings institutions were often unwilling to offer consumer loans.

In 1920, Edward Filene hired Roy Bergengren, a poverty lawyer, to manage the Massachusetts Credit Union Association and promote the growth of credit unions. Within a year, Massachusetts chartered 19 new credit unions. Encouraged by this success, Filene organized the Credit Union National Extension Bureau, with Bergengren managing it, to promote the establishment of credit unions throughout the United States. By 1925, 26 states had enacted laws allowing the formation of credit unions. By 1930, 32 states had adopted credit union laws, and there were more than 1,100 credit unions in operation.

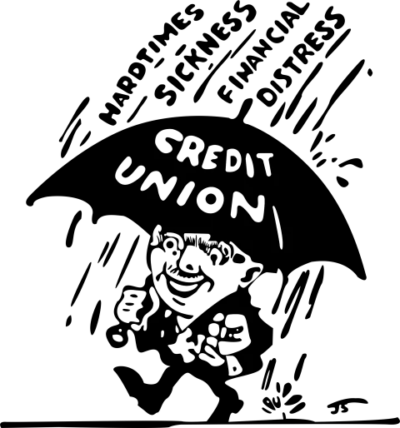

A Symbol of Protection and Solidarity

Source: umbrellaman.org

In 1923, as the U.S. credit union movement was gaining momentum, Roy Bergengren, a key figure in the movement, recognized the importance of an emblem that captured the spirit and purpose of credit unions. He commissioned Joseph Stern of the Boston Globe to create a symbol that would resonate with members and represent the safe haven credit unions provide. Thus, the “Little Umbrella Man” was born.

This uplifting icon depicted a joyful credit union member shielded by an umbrella—symbolizing the credit union’s role in helping people weather life’s financial challenges. Copyrighted in 1936, the “Little Umbrella Man” served as the official emblem for CUNA (now America’s Credit Unions) and its affiliated organizations for over 40 years. Until the 1960s, he stood as the most recognizable figure of the movement, representing a legacy of community, security, and support.

A National System

In 1934, President Franklin Delano Roosevelt signed the Federal Credit Union Act into law, establishing a national system to charter and supervise federal credit unions. Over the next two decades, the credit union movement grew steadily. By 1960, more than 6 million individuals were members of over 10,000 federal credit unions.

Expansion of Services

In the 1970s, the financial landscape began to change. Federal legislation passed in 1977 allowed credit unions to offer new services to members, such as share certificates and mortgages. During this decade, credit union membership more than doubled, and assets tripled to exceed $65 billion. In 1970, the National Credit Union Administration (NCUA) became an independent federal agency, and Congress created the National Credit Union Share Insurance Fund (NCUSIF) to protect deposits at credit unions.

Today’s Credit Union Landscape

Today, more than 6,500 credit unions across the country continue to provide affordable, community-driven financial services. Their evolution reflects both their long-standing cooperative principles and their ability to adapt to the changing needs of their members.